difference between calico and dilute calico

2025-01-11

difference between calico and dilute calico

difference between calico and dilute calico

Here's when Unitas knocks off for Christmas - and how to get an emergency repairNone

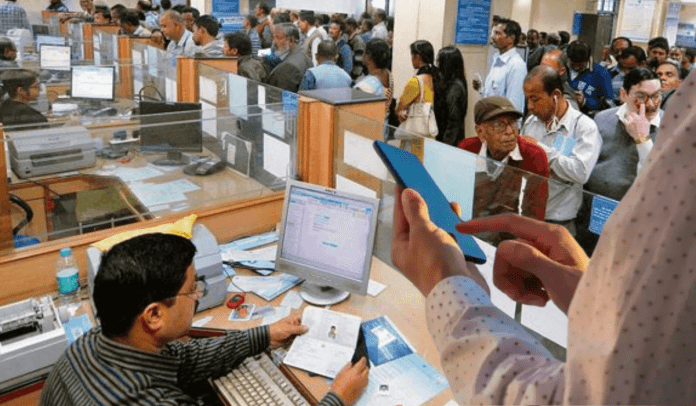

is increasingly being considered one of the major drivers of digital transformation in Africa and other parts of the world. This is partly because it has the power to change lives and communities, allowing them the opportunity to access different services and contribute to the growth of their economies. There is thus no gainsaying the importance of tools like digital identity that enable financial inclusion to the overall digital transformation agenda of many African countries, including those of the Central Africa subregion, grouped under the umbrella of the Central Africa Economic and Monetary Community (CEMAC). These countries include Cameroon, Central African Republic, Chad, Republic of Congo, Equatorial Guinea and Gabon and have a combined population of more than 60 million people. The region has an ambitious plan to achieve a 75 percent financial inclusion rate by 2030 through an initiative by the Bank of Central African States (BEAC) to ensure the establishment of across the six countries in the next five years. The mid-term plan is to have 350,000 such payment points by 2027. It’s worthy of note that this part of the continent faces considerable economic inequalities that seriously threaten the realisation of this ambition. ID4Africa Executive Chairman, Dr. Joseph Atick, and Cameroonian tech startup consultant, Ayuk Etta, share their expert views on how the CEMAC subregion can lay the foundation for a stronger financial inclusion push in order to advance economic growth and development. CEMAC is considered the least developed and least tech-driven subregion in Africa, despite its huge economic growth potential and strategic geographical location of its member states. A large segment of the population here remains either unbanked or underbanked, which hinders both development and economic freedom especially among vulnerable groups of persons such as women and adults with lower-incomes. According to the International Monetary Fund (IMF) and the World Bank’s , the number of adults in this region who are unbanked is below the global average. It is the same case with Cameroon which is considered the region’s biggest economy, as well as all the other five countries. In the Republic of Congo, just around 18 percent of adults were said to have a formal relation with banking institutions as of 2021. The situation is in the Central African Republic where less that 15 percent of the population is said to have a bank account, while just around 14 percent of adults are able to participate in any form of financial transaction such as mobile money services. At least 74 percent of women across the subregion are estimated to be financially excluded. In its , BEAC noted that the overall rate of financial inclusion in the subregion stood at 32 percent as of that year. What this means, experts say, is that innovative tech solutions as well as the right digital infrastructure and policies could possibly offer a window to effectively address major loopholes in financial accessibility in the region. The low level of financial inclusion within CEMAC, just like in other regions of Africa, is blamed on a litany of factors which include a paucity of digital public infrastructure, high cost, a weak and unaligned regulatory environment, and other socio-economic factors such as a high rate of poverty among countries of the subregion. To enable wider participation in the financial ecosystem of CEMAC, it is vital to consider changes to a number of things, including enhancing efforts in financial literacy. It also requires starting from the basics such as building the appropriate digital public infrastructure (DPI), says digital ID expert and Executive Chairman, Dr Joseph Atick. “I think the very first thing, of course, is getting people into the national population registers. If they are not registered, then there is nothing you can do to enable them to participate. It is clear from the standards and best practices within the financial sector that identity is a pillar upon which you have to build financial services,” he tells in an interview. “You cannot do anonymous if you are to protect the financial ecosystem from being hijacked from fraud, from criminal activity, from money laundering, from the criminal networks that will exploit it. You must have a reliable, robust identity system that has maximum coverage of the population. That is the prerequisite for financial inclusion. You can’t talk about financial inclusion without talking about identity.” Further stressing the place of digital identity in financial inclusion, Atick avers: “Financial inclusion is highly correlated and related to digital identity. And our statistics show that the penetration of digital identity is very low in the Central Africa region, which is actually among the regions that are hardest hit by certain economic conditions. This can have a corresponding [negative] impact on financial inclusion. I expect that financial inclusion has a long way to go in many areas in Africa.” , a Cameroonian tech startup architect agrees with Atick on the need for robust digital infrastructure such as digital identity, which for now, is almost entirely inexistent in CEMAC countries. At the moment, only a national digital ID system as part of its DPI journey. “To do this, I think it’s important to implement strategies, set up the right infrastructures, get the appropriate policies and innovative methods to be able to push the agenda of financial inclusion,” Etta notes. “I believe the infrastructure needs to be extended to be able to get to those people down there. That would also mean building more digital infrastructure generally speaking, like digital identity systems. We understand this is an important aspect of driving financial inclusion. We also need interoperable data exchange platforms.” “If we don’t build this infrastructure, which I believe is the driving force of digital transformation, we will not go far. It will always be at a level where we are trying, or not getting it done. If digital identity is not properly implemented, there are many things that cannot happen. Financial inclusion is also about how people access loans easily. If you cannot properly identify somebody digitally, for instance, you cannot give them a digital loan,” Etta, who’s also CEO of , a tech and innovation company in Cameroon, argues. Beyond the infrastructure, financial inclusion would see a leap forward in CEMAC if the right policies and platforms exist. “The number two thing is that you have to have the right policies in place which are going to establish what would constitute acceptable identity authentication for identity transactions. So, be it for onboarding or identity transactions, you have to have a policy. Saying that we’re going to do biometric authentication for every transaction, no matter what value it is and what context it is, doesn’t make any sense,” Atick holds. “You have to have a policy that is basically a risk-based policy. And we have lots of experience in that. Some countries started with their own policies, and over time, they started to understand it. Luckily, there is a lot of knowledge now that we can share on this point. This is why we’re doing the Financial Inclusion Symposium at the ID4Africa Annual General Meeting next year [ ], because these countries are going to share their knowledge and experiences.” “The symposium at the AGM will basically be on digital identity and finance. It’s going to focus on the stages of financial inclusion, and what are the risk-based policies countries must put in place to achieve the desired outcome, which is a low-cost, high-robustness and trustworthy ecosystem that enables anybody to enter the system and to conduct transactions securely.” Talking about another important aspect, which is having the financial platform, Atick explains: “Even if people are known to you in the Civil Register or the National Population Register; if you do not have the financial platforms and access to these financial platforms, then you cannot participate. So, you need a mobile phone, for instance. Digital identities are now issuing credentials which have QR codes.” “It could be a mobile phone, either smart, which is a problem in many countries, or a feature phone. But apart from that, you should also be able to give people paper-based IDs with digital seals that are able to link the physical world to the digital world upon which the financial ecosystem runs. You have to make sure that there is a financially suitable credential, and that’s easily presentable so that people can use it and can link to it.” To Atick, the other important thing to do is to encourage the people to accept and use the issued identity credential for the purpose of payment. “We have several countries which have now achieved total coverage of the population for their ID program but there is still limited use of the ID in the financial sector. Therefore, I would not say that they are financially included because people got IDs. It’s like I have a bank account, but I cannot use it. Don’t mistake that for financial inclusion. Financial inclusion has to be real, practical, accessible,” Atick insists. While countries in the CEMAC region and the continent at large look to build their infrastructure to propel financial inclusion, they must have issues like fraud and scale in mind. They must build systems that are scalable and have strong security measures around them to prevent financial fraud and other forms of criminal intrusion. “There are countries that are scaling up their systems so that everyone can use them, but these countries are struggling with fraud which is at all levels of society. We have seen even in the developed world where financially included people are targeted. Fraudsters use social engineering by targeting the weakest link in the digital chain which is the human.” “Financial inclusion is a very, very complex ecosystem. It’s not just about giving excluded people or the poor access to bank accounts. It is about enabling a robust and highly fraud-resistant ecosystem that allows transactions for service delivery.” As part of the push, fintechs, mobile money services, and other instant payment systems are also playing a major role in opening up the financial space for millions of citizens of the subregion, even if such instant payment infrastructures are limited and not inclusive. According to a SIIPS report , the CEMAC subregion has the lowest number of live and operating instant payment systems (IPS). Although it has one regional IPS dubbed , the efforts remain slow and the system has its limitations as it is linked to a bank card, meaning you must have a bank account to be able to use the service. In a report on financial services within CEMAC in 2022, BEAC said just two percent of all transactions involved traditional bank transfers or cards. In the subregion, there are two major multinational companies, namely MTN and Orange, which offer mobile money banking services. There are many other existing and emerging fintech startups which also facilitate instant payments in the form of mobile money. “The instant payment system is one of the use cases of digital ID that allows the financial identifier to be useful and meaningful. So yes, instant payment is very, very important. But let’s not get hung up on terms: whether it’s digital public infrastructure or not, countries don’t think that way. Countries think of problems and what the practical solutions are. They think of how to deploy the necessary tools and infrastructure,” Atick opines. He notes that for the case of Africa, instant payment services like mobile money helped the continent leapfrog the rest of the world in the last 20 years, despite the interoperability issues the service has suffered. BEAC reported in 2022 that over 96 percent of all transactions within CEMAC that year were completed through mobile money channels. “For many, many years, mobile money was just not interoperable, but it’s still heavily used in East Africa. But I think the time has come for a general interoperable instant money similar to mobile money that used to be there, and that actually connects you to the bank account, so that you have a whole list of services, not just holding your money in a mobile credit with a telephone company,” Atick suggests. “While mobile money was very practical and pragmatic and useful for people as one of the alternative mechanisms that was used to bypass this question of people being bankable or people entering the banking system, it has not led to the reform that we had hoped for, which is that you create an ecosystem with many financial services available to an individual with a bank account that they can use and control with their own consent and with their own mechanisms.” Etta concurs with Atick’s view about having a general interoperable instant payment system similar to mobile money, but notes that innovation is what is likely to play the magic. He also believes there’s need to create the enabling regulatory and policy environment for innovative ventures to germinate and thrive. “Innovation is at the center of this transformation. It’s not going to happen if we don’t adopt innovation. Innovation is simply a new way of doing things or better ways of doing things and solving the problems that we face in a country or in a region like CEMAC. A lot of new technology is coming. Today, there’s generative artificial intelligence. To encourage innovation, the most important thing is to create the right environment,” he holds. “This subregion, like the rest of Africa, has a youthful population and these are people who can drive innovation. One thing that has to be done is to create the right framework. In Cameroon, as an example, we have started a Hackathon which is something that brings together young people to build tech solutions to specific societal problems. That’s our own way of trying to push the spirit of innovation. If that gets done multiple times, I think that there’s a lot that can happen in terms of designing new solutions.” In terms of fintechs development and their contribution to financial inclusion, Etta says Cameroon is on the right path with some industry-led initiatives. “In Cameroon today, there’s a lot that’s being done in terms of fintech development and how the ecosystem is evolving. One major milestone that we have achieved today is the creation of a fintech alliance called the Cameroon Fintech Association, and that is led by some of the really big fintechs in Cameroon,” he says. “One of the things we are doing is having a discussion on how the governments or the Central Bank of the subregion can better understand what fintechs are, what they are doing, and what the different avenues of collaboration are, because we really think it’s important to have a vital and strong fintech ecosystem to push financial inclusion.” Although the current realities reflect a not-to-good image and a long path still to be covered, there is some hope that things will improve, provided countries fully understand where exactly to hit the nail and act accordingly, going forward. “It’s not a technical problem, the infrastructure that is needed for that is known. It’s a matter of policy. And it’s also a matter of motivation. We should ask ourselves what the barriers are that we are trying to remove to advance financial inclusion,” Atick says. “I think the level of awareness is accelerating very, very quickly, and that is good news because awareness means informed policies and informed policies will lead to products and solutions that will be accessible by the populations. And when there’s a feedback cycle, the population adopts. A good policy will reinforce the sustainability of these systems.” Atick adds that the future is bright: “Africa will get a sustainable financial inclusion system because all of the economies that are being built in Africa, whether it’s regional or whether it is continental, all rely on one critical assumption. If that assumption fails, then all these, such as the intercontinental free trade agreement, are going to fail.” “Financial inclusion is not just about allowing the poor to get access to financial services. Financial inclusion is about allowing everybody to participate in a usable digital economy,” Atick mentions. To Etta, this is possible in an atmosphere in which governments stay alert and move along with the changing realities of technology. “Another thing is for the governments to be proactive. I don’t think governments should design policies that stay ten years before they are reviewed, because technology is going so fast. And because technology is going so fast, our policies also need to go so fast, to catch up with the growth of technological solutions.” One such new technologies is generative AI, which Etta strongly believes, is useful to drive financial inclusion and digital transformation, generally speaking. “AI is a super powerful tool that we have to make use of to be able to accelerate some of the decisions and projects we want to execute. We just need to understand how it works and how to use it. But more importantly, how to adapt it to our local context in order to get things better done. “So, I will say three things here: one, we need to understand the power of AI. Two, we need to understand that AI is a tool that we can use to accelerate progress and three, we need to adapt it to our context to understand what some of our nuances are.” “I will add that we also need to have really strong AI policies. At one point, AI is really great, and at the other, AI could be very dangerous. So, we need to have policies that guide its implementation and use, but also those policies should not stifle innovation.” | | | | | | | | |Brooklyn, NY, Nov. 21, 2024 (GLOBE NEWSWIRE) -- - Cemtrex Inc. (NASDAQ: CETX, CETXP), an advanced security technology and industrial services company, today announced that its Board of Directors authorized the stockholders approved 1-for-35 reverse stock split (the “Reverse Stock Split”) of its common stock, par value $0.001 per share (the “Common Stock”). The Reverse Stock Split will become effective at 12:01 a.m. Eastern Time on November 26, 2024 (the “Effective Time”). The Common Stock will continue to trade on The Nasdaq Capital Market under the symbol “CETX” and will begin trading on a post-split basis when the market opens on November 26, 2024. The new CUSIP number for the Common Stock following the Reverse Stock Split will be 15130G881. The Reverse Stock Split is intended to enable the Company to regain compliance with the minimum closing bid price requirement for continued listing on Nasdaq. At the Effective Time of the Reverse Stock Split, every 35 shares of the Company’s issued and outstanding Common Stock will be combined into one share of Common Stock issued and outstanding, with no change to the par value of $0.001 per share. No fractional shares of Common Stock will be issued as a result of the Reverse Stock Split and instead each holder of Common Stock who would otherwise be entitled to receive a fractional share as a result of the Reverse Stock Split will receive one whole share of Common Stock in lieu of such fractional share. The principal effect of the Reverse Split will be that (i) the number of shares of common stock issued and outstanding will be reduced to one-thirty-fifth that amount, and (ii) all outstanding options and warrants (other than the Adjustable Warrants) entitling the holders thereof to purchase shares of common stock will enable such holders to purchase, upon exercise of their options or warrants, one-twentieth of the number of shares of common stock which such holders would have been able to purchase upon exercise of their options or warrants, immediately preceding the Reverse Split at an exercise price equal to 35 times the exercise price specified before the Reverse Split, resulting in essentially the same aggregate price being required to be paid therefor upon exercise thereof immediately preceding the Reverse Split. Other awards under our 2020 Equity Compensation Plan would be subject to proportionate adjustments. ClearTrust, LLC is acting as transfer and exchange agent for the Reverse Stock Split. Stockholders with shares held in certificated form will receive from ClearTrust, LLC instructions regarding the exchange of their certificates. Stockholders that hold shares in book-entry form or hold their shares in brokerage accounts are not required to take any action and will see the impact of the Reverse Stock Split reflected in their accounts, subject to brokers’ particular processes. Beneficial holders of Common Stock are encouraged to contact their bank, broker, custodian or other nominee with questions regarding procedures for processing the Reverse Stock Split. About Cemtrex Cemtrex Inc. (CETX) is a company that owns two operating subsidiaries: Vicon Industries Inc and Advanced Industrial Services Inc. Vicon Industries, a subsidiary of Cemtrex Inc., is a global leader in advanced security and surveillance technology to safeguard businesses, schools, municipalities, hospitals and cities. Since 1967, Vicon delivers mission-critical security surveillance systems, specializing in engineering complete security solutions that simplify deployment, operation and ongoing maintenance. Vicon provides security solutions for some of the largest municipalities and businesses in the U.S. and around the world, offering a wide range of cutting-edge and compliant security technologies, from AI-driven video analytics to fully integrated access control solutions. For more information visit www.vicon-security.com . AIS – Advanced Industrial Services, a subsidiary of Cemtrex, Inc., is a premier provider of industrial contracting services including millwrighting, rigging, piping, electrical, welding. AIS Installs high precision equipment in a wide variety of industrial markets including automotive, printing & graphics, industrial automation, packaging, and chemicals. AIS owns and operates a modern fleet of custom designed specialty equipment to assure safe and quick installation of your production equipment. Our talented staff participates in recurring instructional training, provided to ensure that the most current industry methods are being utilized to provide an efficient and safe working environment. For more information visit www.ais-york.com . For more information visit www.cemtrex.com . Forward-Looking Statements This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the closing of the offering, gross proceeds from the offering, our new product offerings, expected use of proceeds, or any proposed fundraising activities. These forward-looking statements are based on management’s current expectations and are subject to certain risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by such forward looking statements. Statements made herein are as of the date of this press release and should not be relied upon as of any subsequent date. These risks and uncertainties are discussed under the heading “Risk Factors” contained in our Form 10-K filed with the Securities and Exchange Commission. All information in this press release is as of the date of the release and we undertake no duty to update this information unless required by law. Investor Relations Chris Tyson Executive Vice President – MZ North America Direct: 949-491-8235 CETX@mzgroup.us www.mzgroup.us Investor Relations Chris Tyson Executive Vice President – MZ North America Direct: 949-491-8235 CETX@mzgroup.us www.mzgroup.us‘Social revenge attacks’ raising concerns about deeper societal issues in China. What can be done?

It's time for the holidays, which means robust family conversations and seemingly never-ending courses of food. But for the more tech-savvy among us, the journey home could also mean we'll be called on to provide a backlog of tech support to parents, grandparents and other family members. And with generative AI being used to supercharge some major cyber scams this year, it's also a good time to teach and not just fix. Here are some tips on how to manage your tech encounters this holiday season: Whether it's Windows, macOS, iOS or Android, simply keeping your operating system and apps up-to-date will help protect your family's computers and devices against a surprising number of security threats, such as malware, viruses and exploits. Most operating systems, especially those for mobile devices and their app stores, typically have auto-updates turned on by default. Be sure to double-check the device to make sure it has enough storage space to carry out the update. (More on this below.) Keeping apps updated may also reduce the number of "Why isn't this app working?" type of questions from your relatives. Chances are someone in your family is going to have a completely full mobile device. So full, in fact, that they can no longer update their phone or tablet without having to purge something first. There are many approaches to freeing up space. Here are a few you can easily take without having to triage data or apps. According to some admittedly unscientific studies, the average person has hundreds of passwords. That's a lot to remember. So as you help your relatives reset some of theirs, you may be tempted to recycle some to keep things simple for them. But that's one of the bad password habits that cybersecurity experts warn against. Instead, try introducing your forgetful family member to a password manager. They're useful tools for simplifying and keeping track of logins. And if you want to impress a more tech-savvy cousin or auntie, you could suggest switching to a more secure digital authentication method: passkeys. As scammers find new ways to steal money and personal information, you and your family should be more vigilant about who to trust. Artificial intelligence and other technologies are giving bad actors craftier tools to work with online. A quick way to remember what to do when you think you're getting scammed is to think about the three S's, said Alissa Abdullah, also known as Dr. Jay, Mastercard's deputy chief security officer "Stay suspicious, stop for a second (and think about it) and stay protected," she said. Simply being aware of typical scams can help, experts say. Robocalls frequently target vulnerable individuals like seniors, people with disabilities, and people with debt. So-called romance scams target lonely and isolated individuals. Quiz scams target those who spend a lot of time on social media. Check our AP guide on the latest scams and what to do when you're victimized. Home internet speeds are getting faster, so you want to make sure your family members are getting a high-speed connection if they've paid for one. Run a broadband speed test on your home network if they're still rocking an aging modem and router.Andrej Stojakovic made 11 free throws to help craft a team-high 20 points, freshman Jeremiah Wilkinson had his second consecutive big game off the bench and Cal ran its winning streak to three with an 83-77 nonconference victory over Sacramento State on Sunday afternoon in Berkeley, Calif. Wilkinson finished with 16 points and Rytis Petraitis 13 for the Golden Bears (5-1), whose only loss this season was at Vanderbilt. Jacob Holt went for a season-high 25 points for the Hornets (1-4), who dropped their fourth straight after a season-opening win over Cal State Maritime. Seeking a fourth straight home win, Cal led by as many as 12 points in the first half and 40-33 at halftime before Sacramento State rallied. The Hornets used a 14-5 burst out of the gate following the intermission to grab a 47-45 lead. Julian Vaughns had a 3-pointer and three-point play in the run. But Cal dominated pretty much the rest of the game, taking the lead for good on a Petraitis 3-pointer with 14:50 remaining. Stojakovic, a transfer from rival Stanford, went 11-for-15 at the foul line en route to his third 20-point game of the young season. Cal outscored Sacramento State 26-17 on free throws to more than account for the margin of victory. Coming off a 23-point explosion in his first extended action of the season, Wilkinson hit five of his 10 shots Sunday. The Golden Bears outshot the Hornets 47.2 percent to 43.1 percent. Joshua Ola-Joseph contributed 10 points and six rebounds, Mady Sissoko also had 10 points and Petraitis found time for a team-high five assists. Holt complemented his 25 points with a game-high eight rebounds. He made four 3-pointers, as did Vaughns en route to 18 points, helping Sacramento State outscore Cal 30-21 from beyond the arc. EJ Neal added 16 points for the Hornets, while Emil Skytta tied for game-high assist honors with five to go with seven points. --Field Level Media

Conspiracy: You’ve no iota of shame – Atiku’s aide slams BwalaCal staves off Sacramento State for third straight win

Related hot word search:

Previous: calico queen

Next: how to spell calico